Road pricing approaches charge users for use of road infrastructure (motorways, bridges, tunnels, or other infrastructure). They are widely used to fund transport infrastructure and to manage demand for private vehicle-based road transport.

There are many options for setting road pricing. It can be a distance-based charge (e.g. a toll road, defined by the length of the road), and/or time-based (i.e. vary according to when the infrastructure is being used).

Charges may also vary depending on the number of people in a car to incentivise more efficient/shared vehicle use. They may also vary with a vehicle’s fuel efficiency and related CO2 emission values to incentivise the uptake of more fuel-efficient and low or zero (tailpipe) emission vehicles (LZEVs). In this case, adequate vehicle testing, reporting and labelling systems [2] with information about vehicles’ fuel efficiency/emission levels would be required.

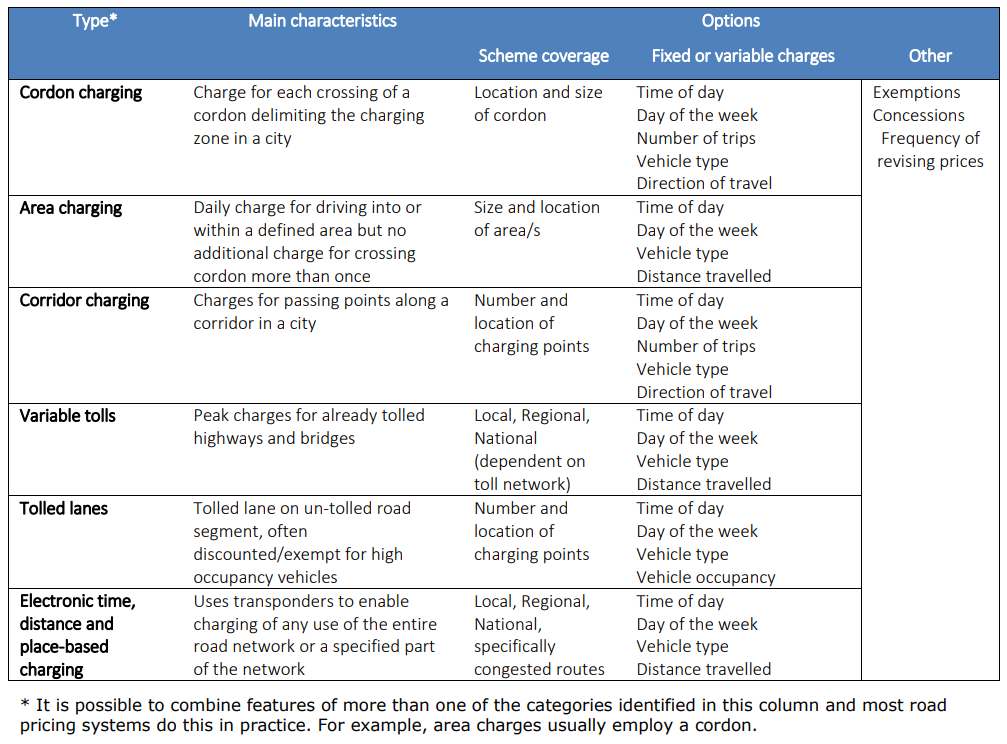

Different types of road pricing measures are shown in the table below.

Table 1: Road pricing measures (ITF, 2018)

Distance- and time-based charges, if carefully designed, have the potential to deliver more efficient road transport as they can account for various external costs related to driving. For example, distance-based charges can vary depending on the average pollution profile and weight of a vehicle, reflecting costs related to air pollution and road damage. They can also mirror spatial and temporal variation in driving, reflecting population exposure to external costs, such as noise and air pollution, and integrating costs from congestion during peak hours and busy locations.

Road pricing can incentivize a mode shift to more sustainable transport, such as public transport or other shared vehicle services. For this to work, high quality provision of alternative transport services is needed, alongside incentives to use them (e.g. real-time information).

Tolls on selected routes can shift the traffic onto non-tolled routes, potentially increasing total kilometres travelled and offset the reduction in CO2-emisisons by some degree.

A review of 8 distance-based road pricing simulations and 1 ex-post evaluation (Cavallaro et al, 2018) found the schemes were estimated to reduce CO2 emissions by between 5% and 20% (most studies reviewed were in Europe). The assumptions for the case studies vary by time restriction, charging amount etc. and assume various policies to support the mode shift, productivity increases, fuel efficiency and foregone trips that lead to the CO2 reductions. An ex-post review of Milan’s congestion charging zone in Cerchia Bastioni showed a 35% reduction in C02 in the area compared to the year before it was introduced (Beria, 2016 [3]). There are a number of factors that contributed to this including a reduction in cars entering the charging zone, with nearly 50% reduction in high pollutant vehicles in the area – some of these trips may have not occurred, changed travel time or shifted to alternative modes (Cascade, 2013). [4] The revenue from the charging zone was reinvested in public transport.

Note that secondary effects of road charging schemes need to be taken into account when assessing CO2 emission impacts. For example, road-based vehicle traffic and related CO2 emissions may increase on roads outside of the congestion area as drivers try to avoid charges. They may also be willing to make lengthier detours to avoid charging, increasing total transport activity.

Costs for central or local governments, or infrastructure operators fall into planning, equipment/infrastructure and operating costs. Implementation costs can vary greatly, depending on the technology used, the geographic area or the specific infrastructure to be covered. For example, simple odometer readings can assess distances travelled by a vehicle, but lack the detail needed to implement rates that vary with location and congestion levels. GPS-based systems, which track a vehicle’s position, can accommodate differentiated rates. Systems based on GPS and CCTV controls require a limited amount of ‘hard’ infrastructure and are more cost effective in the long run.

The Victoria Policy Institute (2019) found that toll collection costs are around 10% of total tolling revenue for electronic collection, but can be up to 40% for tollbooths. Van Dender (2019) reviews literature on the costs of electronic tolling systems, concluding that distance-based charging systems were historically expensive, but historical data may not be a good indicator to predict future costs. Technological progress in charging techniques allows systems to be fine-tuned to particular circumstances and be run efficiently to reduce costs compared to historical estimates.

Costs for vehicle labelling systems have to be accounted for where charges are differentiated by certain vehicle characteristics and relevant systems are not in place yet. Regulatory changes may mean vehicle manufacturers must adapt their models, which may increase their manufacturing costs.

The consumer will directly pay the road price set by the infrastructure operator or local/national authorities, or the cost/saving of adapting travel patterns to the charges.

The primary objective of road pricing should be to cut congestion and manage demand for the use of private vehicles. Other forms of taxation that cost less to administer are recommended if the objective is simply to raise revenue.

Co-benefits may include mode shift to less polluting vehicles if people are put off private car travel by the toll (but this will only work if alternative transport options are available) and increased or stabilised revenue from road transport, particularly applicable in countries that currently rely on fuel taxes.

These risks should be considered and mitigation measures may also need to be identified:

Beria, P (2016), Effectiveness and monetary impact of Milan's road charge, one year after implementation, International Journal of Sustainable Transportation, 10:7, 657-669, DOI: 10.1080/15568318.2015.1083638 [9]

Cascade (2013), “Milan’s Congestion Charge Zone”, nws.eurocities.eu/MediaShell/media/Milan%20congestion%20charge.pdf

Cavallaro [10], F., F Giaretta, S Nocera [11] (2018), “The potential of road pricing schemes to reduce carbon emissions [12]”, Transport Policy, 67: 85-92.

Deloitte (2012), “Road Pricing: Necessity or nirvana?”, www.deloitte.com [13]

Eliasson, J. (2010), “So you’re considering introducing congestion charging? Here’s what you need to know” [14], OECD, [15] Paris.

Fleming, D. (2012), “Dispelling the Myths: Toll and Fuel Tax Collection Costs in the 21st Century [16]”, Reason Foundation, California

Ieromonachou, P., S Potter and J Warren [17](2005), “Comparing Urban Road Pricing Implementation and Management Strategies from the UK and Norway”, PIARC Seminar on Road Pricing with emphasis on Financing, Regulation and Equity.

International Transport Forum (2018), “The Social Impacts of Road Pricing: Roundtable Report”, OECD, Paris.

Schwaab, [18] J.A. and S Thielmann, “Policy Guidelines for Road Transport Pricing: A Practical Step-by-Step Approach”, www.unescap.org/sites/default/files/roadprice_fulltext.pdf [19]

Valérie, B. (2013), “Innovative Demand Management Strategies: Road Pricing Schemes”, www.eltis.org/sites/default/files/trainingmaterials/14690_pn13_pricing_o... [20]

Van Dender, K. (2019), "Taxing vehicles, fuels, and road use: Opportunities for improving transport tax practice", OECD Taxation Working Papers, No. 44, doi.org/10.1787/e7f1d771-en [21]

Victoria Transport Policy Institute (2019), “Road Pricing: Congestion Pricing, Value Pricing, Toll Roads and HOT Lanes”, TDM Encyclopedia, https://www.vtpi.org/tdm/tdm35.htm [22], accessed 1 March 2022.

UK Department for Transport (2009), “Feasibility study of road pricing in the UK [23]”, London.gov.uk, accessed 4 July 2022.

Links

[1] https://www.itf-oecd.org/policy/road-charging-and-tolls

[2] https://www.itf-oecd.org/policy/vehicle-and-fuel-labelling

[3] https://itf.itf-oecd.org/users/bassan_d/Documents/BIPD%20Fiche%20indihttps:/www.tandfonline.com/doi/full/10.1080/15568318.2015.1083638viduelle%201x%20copy.pdf

[4] https://nws.eurocities.eu/MediaShell/media/Milan%20congestion%20charge.pdf

[5] https://www.itf-oecd.org/node/24964

[6] https://www.itf-oecd.org/node/25167

[7] https://www.itf-oecd.org/node/25121

[8] https://www.itf-oecd.org/node/25145

[9] https://doi.org/10.1080/15568318.2015.1083638

[10] https://scholar.google.com/citations?user=zujschYAAAAJ&hl=en&oi=sra

[11] https://scholar.google.com/citations?user=aMTiOCMAAAAJ&hl=en&oi=sra

[12] https://www.sciencedirect.com/science/article/pii/S0967070X16304061

[13] http://www.deloitte.com

[14] https://www.internationaltransportforum.org/jtrc/DiscussionPapers/DP201004.pdf

[15] http://www.internationaltransportforum.org/jtrc/DiscussionPapers/DP201004.pdf

[16] https://reason.org/wp-content/uploads/files/dispelling_toll_and_gas_tax_collection_myths.pdf

[17] https://www.piarc.org/ressources/documents/319,6.4-Ieromonachou-0405C11.pdf

[18] https://www.unescap.org/sites/default/files/roadprice_fulltext.pdf

[19] http://www.unescap.org/sites/default/files/roadprice_fulltext.pdf

[20] http://www.eltis.org/sites/default/files/trainingmaterials/14690_pn13_pricing_ok_low_1.pdf

[21] https://doi.org/10.1787/e7f1d771-en

[22] https://www.vtpi.org/tdm/tdm35.htm

[23] https://www.london.gov.uk/sites/default/files/gla_migrate_files_destination/DfT%20road%20pricing%20feasibility%20study.pdf

[24] https://itf.itf-oecd.org/Shared/Decarbonising%20Transport/Transport%20Climate%20Action%20Directory/Post%20launch/0%20COMs%20editing_launch%20measures/6.%20Sixth%2010-x/UK%20Parliament%20House%20of%20Commons%20Transport%20Committee%20(2022),%20Road%20pricing,%20https:/publications.parliament.uk/pa/cm5802/cmselect/cmtrans/789/summary.html