Feebates

Feebate (or "bonus-malus") systems work by taxing inefficient vehicles and subsidising efficient vehicles at the point of sale, typically collecting just enough net revenue to cover implementation costs. Feebates encourage buyers to buy more efficient vehicles. Fees or rebates apply directly at the point of sale and provide an immediate tangible benefit (or dis-benefit). Feebate systems target car buyers and encourage vehicle manufacturers to improve the fuel efficiency of even their most efficient vehicles to gain some competitive advantage. In contrast, vehicle economy or efficiency standards, which target car manufacturers, usually do not incentivise doing more than the required minimum.

Feebates are a substantial complementary measure to vehicle fuel economy or CO2 standards. France, Canada, Norway and Denmark and others have implemented feebate schemes.

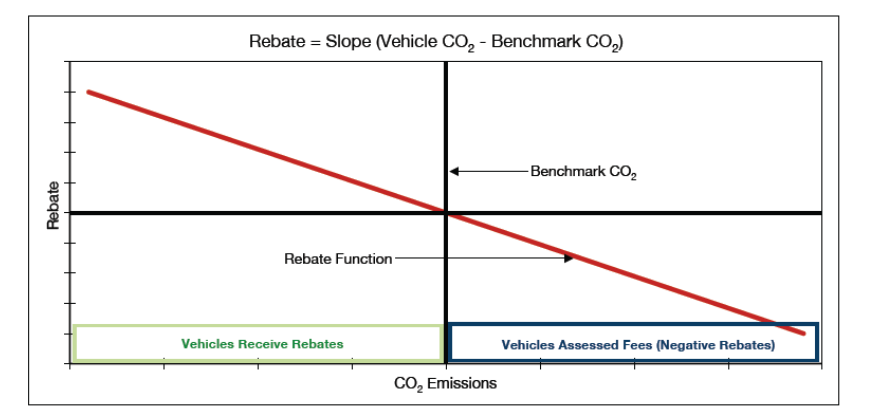

The fee or rebate is typically determined by a benchmark vehicle fuel efficiency value, also called the 'pivot point' efficiency, and, in the case of linear fee or rebate, by the formula fb = r(pp - fe) where:

fb = fee or rebate

r = a constant rate across all vehicles

pp = pivot point (or benchmark CO2) fuel efficiency, adjusted frequently to ensure revenue neutrality and continuous efficiency improvements

fe = the vehicle’s fuel efficiency/ tailpipe CO2 emissions, measured in fuel consumed or tailpipe CO2 emissions per distance travelled

Existing feebate programmes deviate from this model in various ways, all of which may compromise their efficiency. For example:

- Discontinuous feebates (i.e. step functions instead of linear/continuous functions, as used in France until 2017) eliminate the incentive to improve fuel economy for car models whose efficiency is not near a threshold. They incite manufacturers to design vehicles that register CO2 emissions during the type-approval tests just below the step function cut points to increase rebates.

- Defining a buffer around the pivot point, within which no fees or rebates are applied, weakens incentives but could reduce administrative costs.

- Establishing different pivot points for different vehicle sizes or classes protects consumer choice but results in smaller CO2 reductions.

- Setting a conservative pivot point, as occurred in France when first implemented, may stimulate car sales and the economy, but it will also drain public funds and may fail to reduce emissions.

Feebates reduce emissions effectively when the feebate rate is high, the pivot point is low and the programme applies to a large market. Although feebate systems have yet to be implemented optimally, empirical and modelled estimates indicate their potential effects on vehicle fuel efficiency increases with new vehicle sales. Assessments of systems that have been put in place estimate their effect on improved vehicle efficiency in new car sales to be in the range of 1-5 g CO2/km (or 1-3%). Modelled estimates of hypothetical systems point to higher potentials for vehicle efficiency improvements in vehicle sales (often up to around 10%) where systems are implemented optimally.

Such estimates typically do not account for possible rebound effects: that more efficient vehicles that are less expensive to operate may result in increased vehicle activity and hence emissions. These effects can offset some of the CO2 reduction potential of feebate systems.

Empirical

- In France, the feebate system resulted in a reduction of the average emissions per new vehicle of around 1.6%. However, total emissions actually increased due to high vehicle sales and rebound effects, such as increased driving. Studies concluded that appropriately setting the pivot point would have resulted in emissions reductions (Durrmeyer, 2018; D'Haultfœuille, 2013).

- The reformed vehicle purchase tax in The Netherlands, which resembles a feebate system, was found to have been responsible for improvements of the vehicle efficiency in 2013 new vehicle sales of around 4 g CO2/km (Kok, 2015). The study does not consider any potential rebound effects.

Modelled

- A feebate system in California with average rebates of USD 600 and fees of USD 700 would reduce new vehicle emission rates by 6 g CO2/km (3%). Applying across the United States would reduce new vehicle emission values by 15 g CO2/km (or 10%) with average rebates of USD 600 and fees of USD 500 (Bunch, 2011).

- As a stand-alone policy, feebates can reduce carbon emissions from new vehicle sales by 7-9% (Vooren, 2015).

- In the UK, feebates could achieve 3-8% reductions in life-cycle emissions from cars (Brand, 2013).

- An optimal feebate programme in Ontario, Canada, would have reduced lifetime carbon emissions by 13% for cars sold in 2010 (Rivers, 2014).

Existing feebates systems only look at a vehicle's tailpipe emissions (based on recognised test procedures, such as the Worldwide Harmonised Light Vehicle Test Procedure, WLTP). They do not consider upstream (i.e. so-called well-to-tank) emissions from the provision of energy. These can be significant in the case of low- or zero- (tailpipe) emission vehicles (LZEVs, such as electric vehicles), depending on the emissions stemming from the provision of energy, or power generation more specifically. Given the expected increased uptake of LZEVs, future feebate systems should be designed to account for vehicle life-cycle emissions.

If the pivot point is set appropriately, feebate systems should incur only an administrative cost of about USD 100 per vehicle sold; costs for rebates should be outweighed by revenues from fees.

The feebate system implemented in France, considered too generous (potentially on purpose as it mainly benefited small cars where French OEMs dominate the market), cost EUR 164 per car sold between 2008 and 2011 as consumers reacted more strongly than expected.

Feebates may also incur costs for vehicle manufacturers to enhance the fuel efficiency of their vehicles. This can happen when long-run market demand for more efficient vehicles and resulting profits cannot offset manufacturers' research and development investments, e.g. when fuel prices are low. Vehicle buyers may thus be subject to higher average vehicle sales prices, where manufacturers pass vehicle development costs on to the consumer. Usually, these are compensated by lower fuel spending will fade over time as technology costs decrease, and manufacturers can offset upfront investments in research and development.

Since car buyers tend to undervalue fuel economy, feebates help nudge car buyers into choosing vehicles that save them money in the long term. Feebates also push carmakers to accelerate investments in efficient technologies, which ultimately generate 10 - 20 times more CO2 reductions than short-term estimates suggest.

Feebates also incentivise the purchase of smaller cars, which are, on average, also more fuel-efficient. Smaller cars can provide safety benefits and reduce street space use (see the related measure on Vehicle weight standards).

Feebates can have adverse effects, especially when designed with sub-optimal variations.

- If feebates only account for carbon emissions, they can increase sales of vehicles that are more harmful to local air quality, such as pre-Euro6d diesel vehicles. Feebates in France increased emissions of local air pollutants by 2.2-2.8% (Durrmeyer, 2018).

- Feebates can trigger "rebound effects", whereby a lower cost of driving increases travel demand. Rebound effects are estimated to undo 10-20% of the carbon mitigation implied by improved fuel economy.

- Feebate systems that establish multiple pivot points based on vehicle footprints can perversely incentivise automakers to enlarge their vehicles, which in return increases emissions and accident-related externalities.

- As is the case with other measures that incentivise vehicle fuel economy, feebates risk a rebound effect, i.e. vehicle users driving more thanks to lower vehicle operation costs. This effect should be mitigated via adequate demand management measures.

Several policies can complement feebate systems or address potential adverse effects.

- Feebates can be combined with fuel economy standards, such as vehicle CO2 efficiency or corporate average fuel economy (CAFÉ) standards as implemented in the EU and the USA. They are aimed at OEMs and are therefore an adequate measure to be combined with feebates. Such standards sometimes include incentives for new technologies, such as LZEV mandates, to increase adoption of technologies that will be necessary to meet long-term emission goals.

- Feebate rates could be based on local air pollutants, as well as greenhouse gas emissions, to avoid adverse health impacts.

- Demand measures, such as fuel tax increases or charging for road use, can help reduce a potential rebound effect.

There are also certain behavioural aspects that are worth considering when introducing feebates:

- Consumers tend to undervalue fuel economy.

- Price signals are especially salient at point of sale, and can be made more so with campaigns.

- Feebate systems are ideally accompanied by a coordinated vehicle labelling scheme to ease the understanding of vehicle efficiency and its impacts on vehicle use by potential vehicle buyers.

ITF (2021) Transport Climate Action Directory – Feebates

https://www.itf-oecd.org/policy/feebates

Adamou A., Clerides S., Zachariadis T. (2014) Welfare Implications of Car Feebates: A Simulation Analysis, https://academic.oup.com/ej/article-abstract/124/578/F420/5076969

BenDor T. and Ford A. (2006) Simulating a combination of feebates and scrappage incentives to reduce automobile emissions, https://www.sciencedirect.com/science/article/abs/pii/S0360544205001404

Brand C., Anable J., Tran M. (2013) Accelerating the transformation to a low carbon passenger transport system: The role of car purchase taxes, feebates, road taxes and scrappage incentives in the UK, https://www.sciencedirect.com/science/article/abs/pii/S0965856413000177

Bunch D.S. and Greene D.L. (2011) Potential Design, Implementation, and Benefits of a Feebate Program for New Passenger Vehicles in California, http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.470.8259&rep=rep1&type=pdf

Callonnec G. and Sannié I. (2009) Evaluation of the economic and ecological effects of the French 'bonus malus', https://www.eceee.org/static/media/uploads/site-2/library/conference_proceedings/eceee_Summer_Studies/2009/Panel_2/2.273/paper.pdf

Cambridge Econometrics (2014) Effectiveness of CO2-based feebate systems in the European passenger vehicle market, https://theicct.org/publications/effectiveness-co2-based-feebate-systems-european-passenger-vehicle-market

Davis W.B. et al. (1995) Effects of feebates on vehicle fuel economy, carbon dioxide emissions, and consumer surplus, https://trid.trb.org/view/459571

De Haan P., Mueller M. G., Scholz R.W. (2009) How much do incentives affect car purchase? Agent-based microsimulation of consumer choice of new cars—Part II: Forecasting effects of feebates based on energy-efficiency, https://www.sciencedirect.com/science/article/abs/pii/S0301421508006575

D'Haultfœuille X., Givord P., Boutin X. (2013) The Environmental Effect of Green Taxation: The Case of the French Bonus/Malus, https://academic.oup.com/ej/article/124/578/F444/5076980

Du Plooy J. and Nel R. (2012) A Study of a Feebate Policy Aimed at Vehicle Manufacturers to Reduce CO2 Emissions, http://scholar.sun.ac.za/handle/10019.1/82370

Dumas A., Greene D.L., Bourbeau A. (2007) Driving Climate Change: Cutting Carbon from Transportation, https://www.sciencedirect.com/science/article/pii/B9780123694959500087

Durrmeyer I. (2018) Winners and Losers: The Distributional Effects of the French Feebate on the Automobile Market, http://publications.ut-capitole.fr/26241/

Fergusson M. (2012) A Feebate Scheme for the UK, https://bettertransport.org.uk/sites/default/files/research-files/Feebates_report.pdf

Gillingham K. (2013) The Economics of Fuel Economy Standards versus Feebates, http://www.ourenergypolicy.org/wp-content/uploads/2013/07/Gillingham-CAFE-Standards-vs-Feebates-Apr-20131.pdf

Gillingham K. (2011) The consumer response to gasoline price changes: empirical evidence and policy implications, https://stacks.stanford.edu/file/druid:wz808zn3318/Gillingham_Dissertation-augmented.pdf

Greene D.L. et al. (2005) Feebates, rebates and gas-guzzler taxes: a study of incentives for increased fuel economy, https://www.sciencedirect.com/science/article/abs/pii/S0301421503003045

ICCT (2018) Practical lessons in vehicle efficiency policy: The 10-year evolution of France's CO2-based bonus-malus (feebate) system, https://theicct.org/blog/staff/practical-lessons-vehicle-efficiency-policy-10-year-evolution-frances-co2-based-bonus

ICCT (2010) Best Practices for Feebate Program Design and Implementation, https://www.fiafoundation.org/transport/gfei/autotool/approaches/economic_instruments/ICCT_feebate_may10.pdf

Kok R. (2015) Six years of CO2-based tax incentives for new passenger cars in The Netherlands: Impacts on purchasing behavior trends and CO2 effectiveness, https://www.sciencedirect.com/science/article/abs/pii/S0965856415000877

Liu C. and Greene D.L. (2014) Vehicle Manufacturer Technology Adoption and Pricing Strategies under Fuel Economy/Emissions Standards and Feebates, https://www.jstor.org/stable/24694919?seq=1

McManus W.S. (2007) Economic Analysis of Feebates to Reduce Greenhouse Gas Emissions from Light Vehicles for California, https://deepblue.lib.umich.edu/bitstream/handle/2027.42/55180/UMTRI-2007-19-2.pdf?sequence=1

Mims N. and Hauenstein H. (2008) Feebates: A Legislative Option to Encourage Continuous Improvements to Automobile Efficiency, https://rmi.org/wp-content/uploads/2017/05/RMI_Document_Repository_Public-Reprts_Feebate_final.pdf

OICA (2020) 2005-2019 Sales Statistics, http://www.oica.net/category/sales-statistics/

Rivers N. and Schaufele B. (2014) New Vehicle Feebates: Theory and Evidence, https://www.ivey.uwo.ca/cmsmedia/1361413/new-vehicle-feebates.pdf

Teusch J. and Braathen N.A. (2019) Chapter 14: Ex-post cost-benefit analysis of environmentally related tax policies: building on programme evaluation studies, https://www.elgaronline.com/view/edcoll/9781789904178/9781789904178.00027.xml

Van der Vooren A. and Brouillat E. (2015) Evaluating CO2 reduction policy mixes in the automotive sector, https://www.sciencedirect.com/science/article/abs/pii/S2210422413000701

Zachariadis T. and Clerides S. (2015) Feebates as a Fiscal Measure for Green Transportation: Insights from Europe and Policy Implications, https://www.greengrowthknowledge.org/sites/default/files/Zachariadis_Feebates_as_a_Fiscal_Measure_for_Green_Transportation.pdf